Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Bonanza Creek Energy, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

April 27, 2016

Dear Stockholder:

You are cordially invited to join us for our 2016 Annual Meeting of Stockholders to be held on Monday, June 6, 2016 at 11:00 a.m. at 410 17th Street, Suite 220, Denver, Colorado 80202.

The materials following this letter include the formal Notice of Annual Meeting of Stockholders and the proxy statement. The proxy statement describes the business to be conducted at the meeting, including the election of two directors; the ratification of the appointment of Hein & Associates LLP as our independent auditors for the 2016 fiscal year; and the approval on a non-binding advisory basis of the 2015 compensation of our named executive officers.

Whether you own a few or many shares of our stock, it is important that your shares be represented. Regardless of whether you plan to attend the Annual Meeting in person, please take a moment now to vote your proxy by completing and signing the enclosed proxy card and promptly returning it in the envelope provided, or by granting a proxy and giving voting instructions by telephone or the internet. Instructions on how to vote your shares are located on your proxy card or on the voting instruction card provided by your broker.

The officers and directors of Bonanza Creek appreciate and encourage stockholder participation. We look forward to seeing you at the Annual Meeting.

| Sincerely, | ||

| ||

Richard J. Carty President and Chief Executive Officer |

BONANZA CREEK ENERGY, INC.

410 17th Street

Suite 1400

Denver, Colorado 80202

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of Bonanza Creek Energy, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders of Bonanza Creek Energy, Inc. (the "Company") will be held at the Sheraton Denver Downtown Hotel, 1550 Court Place,410 17th Street, Suite 220, Denver, Colorado 80202, on Thursday,Monday, June 6, 2013, 9:2016, 11:00 a.m. local time (the "2013"2016 Annual Meeting"). The 20132016 Annual Meeting is being held for the following purposes:

1) To elect the Class I directors named in this proxy statement to our board of directors;

2) To ratify the selection of Hein & Associates LLP as the Company's independent registered public accountant for 2013;2016;

3) To approve, on an advisory basis, the compensation of our named executive officers; and

4) To transact such other business as may properly come before the 20132016 Annual Meeting.

These proposals are described in the accompanying proxy materials. You will be able to vote at the 20132016 Annual Meeting only if you were a stockholder of record at the close of business on April 29, 2013.22, 2016.

By Order of the Board of Directors, | ||

| ||

Denver, Colorado

April 30, 201327, 2016

Please sign, date and promptly return the enclosed proxy card in the envelope provided, or grant a proxy and give voting instructions by telephone or the internet, so that you may be represented at the meeting.2016 Annual Meeting. Instructions are on your proxy card or on the voting instruction card provided by your broker.

GENERAL INFORMATION | 1 | |||

Stockholders of Record and Beneficial Owners | 1 | |||

Quorum and Voting | ||||

DIRECTORS AND EXECUTIVE OFFICERS | 3 | |||

CORPORATE GOVERNANCE | ||||

Our Company | ||||

Corporate Governance Guidelines | ||||

Board Leadership | ||||

Communications with the Board | ||||

Director Independence | ||||

Director Qualifications | 7 | |||

Independent Director Share Ownership Requirements | 8 | |||

| ||||

Oversight of Risk Management | ||||

Meetings and Committees of Directors | 9 | |||

Audit Committee | 10 | |||

Compensation Committee | 10 | |||

Nominating and Corporate Governance Committee | ||||

| 11 | |||

Environmental, Health, Safety and Regulatory Compliance Committee | 11 | |||

| ||||

| ||||

Attendance at Annual Meetings | ||||

| ||||

COMPENSATION DISCUSSION AND ANALYSIS | ||||

Executive Summary | ||||

Methods to Achieve Compensation | ||||

Executive Compensation Risk | ||||

Setting Executive Officer Compensation | ||||

Elements of Our 2015 Compensation and Why We Pay Each Element | ||||

2015 and Selected 2016 Compensation Actions | 22 | |||

Executive Officer Stock Ownership Guidelines | ||||

Accounting and Tax Considerations | ||||

Indemnification | 32 | |||

Summary Compensation Table | ||||

Grants of Plan-Based Awards | ||||

Narrative Discussion of Summary Compensation Table and Grants of Plan-Based Awards Table | ||||

Outstanding Equity Awards at Fiscal Year End | ||||

Options Exercised and Stock Vested | ||||

Pension Benefits | 38 | |||

Non-Qualified Deferred Compensation | 38 | |||

Potential Payments Upon Termination and Change in Control | ||||

| ||||

| ||||

Director Compensation | ||||

| ||||

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | ||||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | ||||

COMPENSATION COMMITTEE REPORT | 42 | |||

AUDIT COMMITTEE REPORT | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 45 | |||

Section 16(a) Beneficial Ownership Reporting Compliance | 46 |

i

| | i | |

| ||||

| ||||

| ||||

TRANSACTIONS WITH RELATED PERSONS | ||||

Procedures for Review, Approval and Ratification of Related Person Transactions | ||||

| ||||

ITEM ONE: ELECTION OF DIRECTORS | ||||

ITEM TWO: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANT | ||||

Audit and Other Fees | ||||

ITEM THREE: ADVISORY VOTE ON EXECUTIVE COMPENSATION | ||||

OTHER MATTERS | ||||

Stockholder Proposals; Identification of Director Candidates | ||||

Solicitation of Proxies | ||||

Stockholder List | ||||

Proxy Materials, Annual Report and | ||||

Internet and Phone Voting | ||||

Forward-Looking Statements |

ii

| | ii | |

BONANZA CREEK ENERGY, INC.

410 17th Street

Suite 1400

Denver, Colorado 80202

PROXY STATEMENT20132016 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors (the "Board") of Bonanza Creek Energy, Inc. ("we," "us," "our," "Bonanza Creek" or the "Company") requests your proxy for the 20132016 Annual Meeting of Stockholders (the "2013"2016 Annual Meeting"), which will be held on Thursday,Monday, June 6, 2013, 9:2016, 11:00 a.m. local time, at the Sheraton Denver Downtown Hotel, 1550 Court Place,410 17th Street, Suite 220, Denver, Colorado 80202. Distribution of these proxy solicitation materials is scheduled to begin on or about May 3, 2013.2, 2016. By granting the proxy, you authorize the persons named in the proxy to represent you and vote your shares at the 20132016 Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the 20132016 Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the 20132016 Annual Meeting. If any other business properly comes before the stockholders for a vote at the 2016 Annual Meeting, your shares will be voted in accordance with the discretion of the holders of the proxy.

If you attend the 20132016 Annual Meeting, you may vote in person. If you are not present at the 20132016 Annual Meeting, your shares may be voted only by a person to whom you have given a proper proxy. You may revoke the proxy in writing at any time before it is exercised at the 20132016 Annual Meeting by delivering to the Company's Secretary of the Company a written notice of the revocation, by submitting your vote electronically through the internet or by phone after the grant of the proxy or by signing and delivering to the Company's Secretary of the Company a proxy with a later date. Your attendance at the 20132016 Annual Meeting will not revoke the proxy unless you give written notice of revocation to the Secretary of the Company before the proxy is exercised or unless you vote your shares in person at the 20132016 Annual Meeting.

Stockholders of Record and Beneficial Owners

Stockholders of Record and Beneficial Owners |

Most of the Company's stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of Record. If your shares are registered directly in your name with the Company's transfer agent, you are considered the stockholder of record with respect to those shares, and proxy materials are being sent by our transfer agent directly to you by our agent.you. As a stockholder of record, you have the right to vote by proxy or to vote in person at the 20132016 Annual Meeting. The proxy materials include a proxy card or a voting instruction card for the 20132016 Annual Meeting.

Beneficial Owners. If your shares are held in a brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in "street name," and proxy materials will be forwarded to you by your broker or nominee. The broker or nominee is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker how to vote. The proxy materials should include a proxy card or a voting instruction card for the 20132016 Annual Meeting.

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 1 | |

Quorum and Voting |

Quorum and Voting

Voting Stock. The Company's common stock, par value $0.001 per share, is the only class of securities that entitles holders to vote generally at meetings of the Company's stockholders. Each share of common stock outstanding on the record date is entitled to one vote.

Record Date. The record date for stockholders entitled to notice of and to vote at the 20132016 Annual Meeting was the close of business on April 29, 2013.22, 2016. As of the record date, 40,263,31649,621,879 shares of the Company's common stock were outstanding and are entitled to be voted at the 20132016 Annual Meeting.

Quorum and Adjournments. The presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote at the 20132016 Annual Meeting is necessary to constitute a quorum at the 20132016 Annual Meeting.

If a quorum is not present, the chair of the meeting or a majority of the stockholders entitled to vote who are present in person or by proxy at the 20132016 Annual Meeting have the power to adjourn the 20132016 Annual Meeting from time to time, without notice other than an announcement at the 20132016 Annual Meeting, until a quorum is present. At any adjourned 20132016 Annual Meeting at which a quorum is present, any business may be transacted that might have been transacted at the 20132016 Annual Meeting as originally notified.

Vote Required. DirectorsThe directors will be elected (Item One) by the affirmative votea plurality of the holders of a pluralityvotes of the shares present, in person or by proxy, and entitled to vote on the election of the directors. Ratification of the selection of the Company's independent registered public accountant for 2016 (Item Two) and approval, on an advisory basis, of the compensation of the Company's named executive officers (Item Three) will require the affirmative vote of the holders of a majority of the shares present and entitled to vote with respect to the matter. An automated system will tabulate the votes.votes cast by proxy for the 2016 Annual Meeting, and the inspector of elections will tabulate votes cast in person at the 2016 Annual Meeting. Brokers who hold shares in street name for customers are required to vote shares in accordance with instructions received from the beneficial owners. Brokers are permitted to vote on discretionary items if they have not received instructions from the beneficial owners, but they are not permitted to vote (a "broker non-vote") on non-discretionary items absent instructions from the beneficial owner. Brokers do not have discretionary voting authority with respect toNon-discretionary items include the election of directors orand approval, on an advisory basis of the compensation of the Company's named executive officers. For ratification of the selection of the Company's independent registered public accountant, brokers will have discretionary authority in the absence of timely instructions from their customers. Abstentions and broker non-votes will count in determining whether a quorum is present at the 20132016 Annual Meeting. Broker non-votes will not have any effect on the outcome of voting on the director electionselection or the advisory vote on compensation of our named executive officers. For purposes of voting on the ratification of the selection of the Company's independent registered public accountant for 2016 and the advisory vote on compensation of our named executive officers, abstentions will be included in the number of shares voting and will have the effect of a vote against the proposal.

Default Voting. A proxy that is properly completed and submitted will be voted at the 20132016 Annual Meeting in accordance with the instructions on the proxy. If you properly complete and submit a proxy, but do not indicate any contrary voting instructions, your shares will be voted as follows:

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 2 | |

If any other business properly comes before the stockholders for a vote at the meeting, your shares will be voted in accordance with the discretion of the holders of the proxy. The Board knows of no matters, other than those previously stated, to be presented for consideration at the 20132016 Annual Meeting.

DIRECTORS AND EXECUTIVE OFFICERS

After the 20132016 Annual Meeting, assuming the stockholders elect the nominees of the Board as set forth in "Item"Item One—Election of directors"Directors" below, the Board will be, and, as of the date of this proxy statement, the executive officers of the Company are:

Name | Age | Title | Director Class | ||||

|---|---|---|---|---|---|---|---|

| Chairman of the Board | I | |||||

Marvin M. | Director | III | |||||

Kevin A. | Director | ||||||

| |||||||

Gregory P. | Director | I | |||||

| 53 | Director | III | ||||

Richard J. Carty | 47 | Director, President and Chief Executive Officer | III | ||||

| |||||||

| Executive Vice | ||||||

| |||||||

| |||||||

Wade E. Jaques | Vice President and Chief Accounting Officer | — |

The Company'sBoard has established the size of the Board at seven directors and the Board currently consists of seven members.six members with one vacancy. The Company's certificate of incorporation provides for the division of the Company's Board into three approximately equal classes. The Board has established the classes as follows: two directors in each of Class I and Class II and three directorscurrent vacancy is in Class III. The current Class I directors are James A. Watt and Gregory P. Raih; the current Class II directors are Gary A. Grove and Kevin A. Neveu; and the current Class III directors are Richard J. Carty, Marvin M. Chronister and Michael R. Starzer.II. The term of office for the Class I directors will expire at the 20132016 Annual Meeting; the term of office of Class II directorsdirector will expire at the Annual Meeting of Stockholders to be held in 2014;2017; and the term of office of the Class III directors will expire at the Annual Meeting of Stockholders to be held in 2015.2018. Each Class I director elected at the 20132016 Annual Meeting will serve a three-year term andor until such director's successor is duly elected and qualified. At each succeeding annual meeting, directors elected to succeed those directors whose terms then expire will be elected for a full term of office to expire at the third succeeding annual meeting of stockholders after their election.

Set forth below is biographical information about each of the Company's directors, nominees for director and executive officers.

Richard J. Carty was elected to our Board in December 2010. Since 2009, Mr. Carty has been President of West Face Capital (USA) Corp, an affiliate of West Face Capital Inc. ("West Face Capital"), a Toronto-based investment management firm, and has served on the board of directors of portfolio companies on behalf of West Face Capital. Prior to that time, Mr. Carty was a Managing

Director of Morgan Stanley Principal Strategies in New York where he led the Special Situations, Strategic Investments and Global Quantitative Equity investment teams. Mr. Carty was at Morgan Stanley & Co. for 14 years in New York and prior to that time was a partner at Gordon Capital Corp, a private Toronto-based investment bank, for five years. We believe Mr. Carty's extensive asset management, capital markets, investment banking and private equity experience bring important and valuable skills to our Board.

Marvin M. Chronister was elected to our Board in March, 2011. Mr. Chronister has over 35 years of experience in the oil and gas industry. Since 2006, he has been an independent investor, energy finance and operations consultant and owner and CEO of Enfield Companies. He was previously a Practice Director with Jefferson Wells and served as a Managing Director with Deloitte & Touche. Mr. Chronister also held prior investment banking positions with Merrill Lynch and Kidder Peabody. His industry experience includes President and CEO of Transwestern, and senior management positions with the Kidde Energy Group and NL Industries. Mr. Chronister most recently served on the Board of Directors of Sonde Resources Corp. from 2009 to 2012, where he held the position of Chairman and Interim CEO from 2009 until 2011. He has also served on several public and private company boards and held leadership positions with numerous industry organizations. Mr. Chronister holds a BBA degree from Stephen F. Austin State University and has attended multiple executive development programs. We believe Mr. Chronister's extensive operations and strategy experience in the oil and gas industry, as well as his finance and accounting experience, brings important and valuable skills to our Board.

Kevin A. Neveu was elected to our Board in March 2011. Mr. Neveu has over 30 years of experience in the oil and gas industry. Currently, Mr. Neveu serves as a director, President and Chief Executive Officer of Precision Drilling Corporation, where he has served as a director and CEO since August 2007. Mr. Neveu was previously President of the Rig Solutions Group of National Oilwell Varco in Houston. Mr. Neveu holds a Bachelor of Science degree and is a graduate of the Faculty of Engineering at the University of Alberta. Mr. Neveu is a Professional Engineer, as designated by the Association of Professional Engineers, Geologists and Geophysicists of Alberta. In 2002, Mr. Neveu completed the Advanced Management Program at the Harvard Business School. Mr. Neveu serves on the board of RigNet Inc. We believe Mr. Neveu's extensive experience in the oil and gas industry as well as his experience on the boards of directors of public energy companies bring substantial leadership and experience to our Board.director.

James A. Watt was appointed to our Board in August 2012.2012 and elected as Chairman effective November 11, 2014. Mr. Watt has served as President and Chief Executive Officer of Warren Resources, Inc., since November 2015. He served as director, President and Chief Executive Officer of Dune Energy, Inc. since 2007.("Dune") from April 2007 to July 2015. Dune Energy filed for Chapter 11 bankruptcy in March 2015 and wound-down its business in September 2015. Prior to joining Dune, Mr. Watt served as the Chief Executive Officer of Remington Oil and Gas Corporation ("Remington") from February 1998 and the Chairman of Remington from May 2003 until Helix Energy Solutions Group, Inc. ("Helix") acquired Remington in July 2006. From August 2006 through March 2007, he served as the Chairman and Chief Executive Officer of Maverick Oil & Gas, Inc. Mr. Watt currently serves on the Boardboard of Helix.directors of Helix where he also serves on the compensation and nominating and governance committees. He received a B.S.Bachelor of Science in Physics from Rensselaer Polytechnic Institute. We believe that Mr. Watt's qualification as an audit committee financial expert and his extensive experience in the oil and gas industry and board and executive leadership positions at other oil and gas companies bring important experience and industry expertise to our Board.

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 3 | |

Gregory P. Raih was elected as a member of our Board in November 2011. Mr. Raih has nearly 40over 46 years of experience indealing with finance and accounting in thematters for public and private sectorscompanies and extensive experience with companies in the oil and gas industry. Since 2010, Mr. Raih has servedcurrently serves on the Boardboard of Directorsdirectors of (i) General Moly, Inc. (AMEX: GMO), a U.S.-based mineral company engaged in the exploration and development of molybdenum projects where he also serves on the audit, finance and mininggovernance and nominating committees and (ii) Jonah Energy LLC, a North American exploration and production company, where he also serves as Chairman of molybdenum.the audit committee. Additionally, Mr. Raih is a National Association of Corporate Director's Board Leadership Fellow. Mr. Raih is a certified public accountant and served as a partner at KPMG LLP from 2002 until his retirement into 2008 and heldas a variety of roles as partner at Arthur Andersen LLP from 1981 to 2002. He served in the energy practice of both firms as the engagement partner on a number of clients in the oil and gas industry. Mr. Raih has a degree in Accounting from the University of Notre Dame. HeMr. Raih's qualifications as an audit committee financial expert provide an essential skill set relevant to his service on our Board and as the chairman of our Audit Committee.

Set forth below is alsobiographical information about each of the Company's current directors and executive officers.

Richard J. Carty was elected as Chairman of the Board upon the Company's formation in 2010 and was appointed by the Board effective November 11, 2014 to serve as the Company's President and Chief Executive Officer at which time he stepped down as Chairman but remained a member of our Board. From 2009 to 2013, he served as President of West Face Capital (USA) Corp, an affiliate of West Face Capital, a Toronto-based investment management firm, and served on the American Instituteboards of Certified Public Accountantsdirectors of portfolio companies. Prior to that period, Mr. Carty was a Managing Director of Morgan Stanley Principal Strategies where he was responsible for the Special Situations, Strategic Investments and the Colorado

Society of Certified Public Accountants.Global Quantitative Equity investment teams. Prior to Mr. Carty's 14 years at Morgan Stanley, he was a partner at Gordon Capital Corp for five years. We believe that Mr. Raih'sCarty's in-depth engagement with the Company since its formation in 2010, his experience in finance, accounting, and risk management, experience managing significant capital resources as an institutional investor in the oil and gas industry and experience on the boards of public companies, bring substantial leadership and skills to our Board.

Marvin M. Chronister was elected to our Board in March 2011 and appointed by the Board on January 31, 2014 to serve as the Company's Interim President and Chief Executive Officer from January 31, 2014 through November 10, 2014. Mr. Chronister has over 36 years' experience in the oil and gas industry. From 2006 to the present, Mr. Chronister has been an independent investor, energy finance and operations consultant and owner of Enfield Companies. From 2004 until 2006, Mr. Chronister was the Financial Operations Practice Director of Jefferson Wells International, Inc. He served as Managing Director of Corporate Finance for Deloitte & Touche from 1990 to 2003, with previous positions in the oil and gas industry and investment banking. He has also served on several public and private company boards and held leadership positions with numerous industry organizations. Mr. Chronister holds a Bachelor of Business Administration degree from Stephen F. Austin State University and has attended multiple executive development programs. We believe Mr. Chronister's qualification as an audit committee financial expert and accountinghis extensive operations and strategic experience in the oil and gas industry, as well as his broadfinance and accounting experience within the oil and gas industry, brings important and valuable skills to our Board.

Michael R. StarzerKevin A. Neveu is a member ofwas elected to our Board andin March 2011. Mr. Neveu is our President and Chief Executive Officer. Mr. Starzer served as a member of the board of managers and President and Chief Executive Officer and a director of our predecessor, Bonanza Creek Energy, LLC ("BCEC"),Precision Drilling Corporation and has held these positions since BCEC's formationjoining the company in 2006.2007. Mr. StarzerNeveu has over 2934 years of experience in the oiloilfield services sector holding technical, marketing, management and gas industry.senior leadership positions over his career. Previously, Mr. Starzer has served in numerous positions in the oil and gas industry evaluating and developing oil, gas, electricity and geothermal resources. From 1983 to 1991, Mr. StarzerNeveu was employed by Unocal Corporation in various engineering and supervisory positions. From 1991 until 1993, Mr. Starzer served with the California State Lands Commission as Statewide Petroleum Reservoir Engineer and worked as a private consultant to the energy industry supervising operations and appraisals of oil, gas and geothermal resources on properties throughout the United States. In 1993, Mr. Starzer returned to Unocal Corporation as an Asset Manager, assisting them with the sale and management of certain assets. Starting in 1995, Mr. Starzer served as an Officer, Manager and Vice President of Berry Petroleum Corporation until co-founding Bonanza Creek Oil Company, LLC ("BCOC"),the Rig Solutions Group of National Oilwell Varco in Houston and has held senior management positions with it and its predecessor companies in London, Moscow, Houston, Edmonton and Calgary. Mr. Neveu currently serves on the board of directors of Finning International and is a predecessor, in 1999.former board member of Rig Net. He is also a member of the Advisory Board for The Heart and Stroke Foundation of Alberta and an advisor for the University of Calgary's School of Public Policy. Mr. StarzerNeveu is a director and member of the Executive Committee for the International Association of Drilling Contractors. Mr. Neveu holds a degree in Petroleum Engineering from the Colorado School of Mines and a MasterBachelor of Science degree inand is a graduate of the

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 4 | |

Faculty of Engineering Management fromat the University of Alaska andAlberta, is a registered professional engineer in petroleum engineering.the province of Alberta, and has also completed the Harvard Advanced Management Program in Boston, Massachusetts. We believe Mr. Starzer'sNeveu's extensive experience in the oil and gas industry, as well as his experience on the boards of directors and serving as management of public energy companies, bring substantial leadership and experience to our Board.

Jeff E. Wojahn was elected as a member of our Board on November 10, 2014. Mr. Wojahn brings over 30 years of oil and gas industry experience to our Board. From 2003 to 2013, Mr. Wojahn served as Executive Vice President of EnCana Corporation and was President of Encana Oil & Gas (USA) Inc. from 2006 to 2013. Beginning in 1985, Mr. Wojahn held senior management and operational positions atin Canada and the United States and has extensive experience in unconventional resource play development. He currently serves as a Strategic Advisory Board member for Morgan Stanley Energy Partners. We believe Mr. Wojahn's significant operational and development experience as an executive of other oil and gas companies brings essential skills and his knowledge regarding our business and operations bring important experience and leadershipperspectives to our company and our Board.

Gary A. GroveAnthony G. Buchanon is a member of our Board and is our Executive Vice President—Engineering and Planning and Interim Chief Operating Officer. Mr. Grove joined BCOC in March 2003 and served as a member of the board of managers and aswas named Executive Vice President and Chief Operating Officer of BCEC. Mr. Groveon August 12, 2013. He joined the Company in August 2012 as Vice President—Rocky Mountain Engineering. He has over 30more than 31 years of experience in theexploration and production operations, including reservoir, completion and production engineering and unconventional oil and gas industry serving in reservoir engineering and management positions with Unocal Corporation and Nuevo Energyexploitation. Immediately prior to joining us. Mr. Grove graduated from Marietta CollegeBonanza Creek, he served as Production Operations Manager for Noble Energy, Inc. and was part of the Wattenberg Business Unit leadership team that was responsible for developing Noble's Wattenberg assets. Before that, he served in 1982 witha variety of management level engineering and operations roles for companies such as Rosetta Resources Inc. (from 2008-2010), Burlington Resources Inc. (now ConocoPhillips) (from 2004-2008), Trend Exploration Company and Mobil Exploration and Production (now ExxonMobil Corporation). He holds a Bachelor of Science degree in Petroleum Engineering. Mr. Grove is an active member with the Society of Petroleum Engineers and has served in various capacities for student and local chapters since 1979. We believe Mr. Grove's extensive experience in the oil and gas industry and his knowledge regarding our business and operations brings important experience and leadership to our Board.

Patrick A. Graham joined BCOC in November 2001, served as a Senior Vice President of BCEC and currently serves as our Executive Vice President—Corporate Development. From 1995 to 2001, Mr. Graham was employed by Berry Petroleum Company where he evaluated acquisition opportunities in California, the Rocky Mountain region and Canada. Mr. Graham gained experience working with major and independent oil companies while employed with Dowell Schlumberger from 1986 to 1995. Mr. Graham received his Bachelors of Science degree in Petroleum Engineering from Texas A&M University and has held various technical positions in Utah, Colorado, New Mexico, California and Alaska.

Christopher I. Humber has served as Senior Vice President, General Counsel and Secretary of the Company since January 1, 2012. Before joining us, Mr. Humber was a practicing attorney focusing on mergers and acquisitions and corporate finance matters for public and private companies, most recently as a partner with the law firm Kendall, Koenig & Oelsner PC in Denver, Colorado, where he served as our outside counsel since 2006. Prior to that, he was an associate with the law firm Hogan & Hartson LLP (now Hogan Lovells) in Denver, Colorado and with the law firm Arnold & Porter LLP in Washington, D.C. and McLean, Virginia. Mr. Humber graduated with high honors from Emory University School of Law where he was Editor-in-Chief of the Emory Law Journal and holds a B.A. in Biology from the University of Colorado at Boulder.

Lynn E. Boone joined us as Senior Vice President—Reservoir Engineering in July 2012. Ms. Boone has worked in the oil and gas industry for 28 years and has significant experience and accomplishments in reserves determination and reporting, compliance, acquisitions and divestitures and corporate planning and reservoir engineering management. Ms. Boone supervises our reservoir engineering activities as it relates to the development and evaluation of oil and gas reserves and resources and is responsible for reserves estimating, reporting and compliance with federal securities regulation. Ms. Boone holds a BS in Chemical and Petroleum Refining Engineering from the Colorado School of Mines and a M.S. in Petroleum Engineering from the University of Oklahoma. Ms. Boone began her career at Unocal Corporation and has worked in lead engineering and reservoir engineering roles with the U.S. Geological Survey, HS Resources and Cody Energy. Most recently, she served as Senior Vice President—Planning and Reserves at Bill Barrett Corporation from 2003 to 2011. Ms. Boone is a co-founder of the Denver Reserves Roundtable Group established for the purpose of sharing "best practices" for reserves estimating and SEC reporting.Marietta College.

Wade E. Jaques serves as the Company's Vice President and Chief Accounting Officer, Controller and Treasurer and performs the duties of principal financial officer.Officer. Mr. Jaques joined Bonanza Creek inon December 8, 2010 as its Controller, was promoted to Chief Accounting Officer in September 2011 and was elected Treasurera Vice President in MarchNovember 2012. Prior to joining Bonanza Creek, Mr. Jaques was the Controller and Assistant Corporate Secretary for Ellora Energy Inc., a Colorado based independent oil and gas company, from October 2005 until shortly after its merger with Exxon Mobil Corporation in August 2010. Prior to joining Ellora Energy, Mr. Jaques was an audit manager at Deloitte & Touche's Denver office serving oil and gas clients. Mr. Jaques holds both a Bachelor's and Master's degree in Accountancy from Utah State University and is a certified public accountant in Texas and Colorado.

Our Company |

Bonanza Creek Energy, Inc. is an independent energy company engaged in the acquisition, exploration, development and production of onshore oil and associated liquids-rich natural gas in the United States. Our oil and liquids-weighted assets are concentrated primarily in the Wattenberg Field in Colorado, (Rockywhich we have designated the Rocky Mountain region)region, and the Dorcheat Macedonia Field in southern Arkansas, (Mid-Continent region). Our management team has extensive experience acquiringwhich we have designated the Mid-Continent region. In addition, we own and operatingoperate oil producing assets in the North Park Basin in Colorado and the McKamie Patton Field in southern Arkansas. The Wattenberg Field is one of the premiere oil and natural gas propertiesresource plays in the United States benefiting from a low cost structure, strong production efficiencies, established reserves and significant expertise in horizontalprospective drilling opportunities, which allows for predictable production and fracture stimulation, which we believe contributes significantly to the developmentreserve growth.

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 5 | |

Table of our sizable inventory of projects.Contents

Corporate Governance Guidelines

Corporate Governance Guidelines |

The Board believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duty to stockholders. The Company's Corporate Governance Guidelines cover the following principal subjects:

Our Corporate Governance Guidelines, including a copy of the current "Code of Business Conduct and Ethics," are posted on our website at www.bonanzacrk.com. Our Corporate Governance Guidelines are reviewed periodicallyannually and as necessary by our Nominating and Corporate Governance Committee, and any proposed additions to or amendments of the Corporate Governance Guidelines will beare presented to the Board for its approval.

The NYSENew York Stock Exchange (the "NYSE") has adopted rules that require listed companies to adopt governance guidelines covering certain matters. The Company believes that theour Corporate Governance Guidelines comply with the NYSE rules.

Board Leadership |

Our Board has separated the chairmanChairman and chief executive officerChief Executive Officer roles. This leadership structure permits the chief executive officerChief Executive Officer to focus his attention on managing our business and allows the chairmanChairman to function as an important liaison between management and the Board, enhancing the ability of the Board to provide oversight of the Company's management and affairs. Our chairmanChairman provides input to the chief executive officerour Chief Executive Officer and is responsible for presiding over the meetings of the Board and executive sessions of the non-employee directors. In 2013,directors, which we expect that an executive session will be held at every regularly scheduled Board meeting.meeting in 2016. Our chief executive officerChief Executive Officer is responsible for setting the Company's strategic direction and for the day-to-day leadership performance of the Company. Based on the current circumstances and direction of the Company and the

experienced membership of our Board, our Board believes that separate roles for our chairmanChairman and our chief executive officer,Chief Executive Officer, coupled with a majority of independent directors and strong corporate governance guidelines, is the most appropriate leadership structure for our Company and its stockholders at this time.

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 6 | |

Communications with the Board |

Stockholders or other interested parties can contact any director (including Mr. Carty,Watt, the Chairman of the Board), any committee of the Board, or our non-employee directors as a group, by writing to them at 410 17th Street, Suite 1400, Denver, Colorado 80202, Attention: Secretary. All such communications will be forwarded to the appropriate member(s) of the Board. Comments or concerns relating to the Company's accounting, internal accounting controls or auditing matters will also be referred to members of the Audit Committee.

Director Independence |

The Company's standards for determining director independence require the assessment of our directors' independence each year.year and periodically as circumstances change. A director cannot be considered independent unless the Board affirmatively determines that he or shesuch director does not have any material relationship with management or the Company, that may interfere with the exercise of his or her independent judgment, including any of the relationships that would disqualify the director from being independent under the rules of the NYSE. The Board assesses the independence of each non-employee director and each non-employee nominee for director under the Company's guidelines and the independence standards of the NYSE. During 2012, the BoardNYSE and has determined that Messrs. Chronister, Neveu, Raih, Watt and Raih were independent, but thatWojahn are independent. As the Company's President and Chief Executive Officer, Mr. Carty wasis not considered an independent based on such standards. Upon his election to our Board in August 2012, the Board determined that Mr. Watt was independent.director.

The NYSE rules require that allAll members of ourthe Company's Audit Committee, be independent within one year following the completion of our IPO. Under the applicable NYSE and SEC phase-in requirements, Mr. Carty served as a member of the Audit Committee until December 14, 2012. Effective December 14, 2012, Mr. Carty was replaced on the Audit Committee by Mr. Watt, who met the independence standards of the NYSE and SEC.

During 2012, West Face Capital, Inc. beneficially owned approximately 53% of our company stock and, therefore, we were a "controlled company" under the listing standards of the NYSE and exempt from the NYSE's corporate governance requirements that all members of our Compensation Committee and Nominating and Corporate Governance Committee be independent.

In January 2013, West Face Capital, Inc. sold 13,000,000 shares of our common stock and reduced its beneficial ownership from approximately 53% to approximately 20%. As a result, we are no longer a controlled company. In April 2013, our Nominating and Corporate Governance Committee and the Board determined that Mr. Carty was independent. Therefore, as of April 2013, all members of our Compensation Committee and Nominating and Corporate Governance Committee are considered independent, and we satisfy thethus satisfying NYSE listing standards.

Director Qualifications |

Our Board believes that individuals who serve as directors should have demonstrated notable or significant achievements in business, education or public service; should possess the requisite intelligence, education and experience to make a significant contribution to the Board and bring a range of skills, diverse perspectives and backgrounds to its deliberations; and should have the highest ethical standards, a strong sense of professionalism and intense dedication to serving the interests of the Company's stockholders. The following are qualifications, experience and skills for Board members which are important to the Company's business and its future:

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 7 | |

Independent Director Share Ownership Requirements |

Our Board has adopted stock ownership guidelines for our independent directors to further align the interests of our independent directors with the interests of our stockholders. Independent directors are required to hold shares of our common stock with a value equal to five times the amount of the annual cash retainer paid to such director for service on our Board. Independent directors are required to achieve the applicable level of ownership within five years of the date on which such independent director was appointed or elected and began participating in our Long-TermAmended and Restated 2011 Long Term Incentive Plan (the "LTIP").

Table Upon reaching the required ownership level based on the then-current closing price of Contentsour common stock, independent directors are not required to accumulate any shares in excess of shares held as of the determination date, regardless of changes in the price of our common stock. All of our independent directors are in compliance with the stock ownership requirements other than Mr. Wojahn who has until 2019 to satisfy such requirement.

Oversight of Risk Management |

While the Board oversees our risk management processes, with particular focus on the most significant risks we face, management is responsible for day-to-day risk management. We believe this division of Audit Committeeresponsibilities is the most effective approach for addressing the risks we face, and Designationthat the current Board leadership structure, with Mr. Watt serving as our Chairman of Financial Experts

the Board and Mr. Carty serving as our Chief Executive Officer, supports this approach by facilitating communication between management and the Board regarding risk management issues. We also believe that this design places the Board in a better position to evaluate the performance of management, more efficiently facilitates communication of the views of the independent directors and contributes to effective corporate governance. The Board evaluated the members of the Audit Committee for financial literacy and the attributes of a financial expert. The Board determinedrealizes, however, that each of the Audit Committee membersit is financially literatenot possible or desirable to eliminate all risk and that Mr. Raihappropriate risk-taking is an audit committee financial expert underessential in order to achieve the standards of the NYSE and SEC regulations.

Oversight of Risk Management

Company's objectives.

Except as discussed below, the Board as a whole oversees the Company's assessment of major risks and the measures taken to manage such risks. For example:example, the Board:

The Company's Audit Committee is responsible for overseeing the Company's assessment and management of financial reporting and internal control risks, as well as other financial risks, such as the credit

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 8 | |

risks associated with counterparty exposure. Management and the Company's independent registered public accountants report regularly to the Audit Committee on those subjects.

The Company's Compensation Committee periodically reviews our compensation programs to ensure that they do not encourage excessive risk-taking and reports its significant findings to the full Board.

Meetings and Committees of Directors

Meetings and Committees of Directors |

TheDuring 2015, the Board held 12 meetings during 2012,eight regular and its non-employeefour special meetings. Our independent directors metroutinely meet in executive session immediately before or after each regularly scheduled meeting of the Board or as otherwise deemed necessary and met nine times during 2012.2015. During 2015, each of our directors attended more than 90% of the Board meetings and no director attended fewer than 75% of the total number of meetings of the Board and his appointed committee meetings.

The Board has five standing committees:following table identifies the Audit Committee,members of each committee and sets forth the Compensation Committee, the Nominating and Corporate Governance Committee, the Reserve Committee and the Environmental Safety and Regulatory Compliance Committee.number of meetings held in 2015:

Name of Director | Audit Committee | Compensation Committee | Nominating & Corporate Governance Committee | Environmental, Health, Safety and Regulatory Compliance Committee | Reserves Committee | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Independent Directors | ||||||||||

| Marvin M. Chronister | ||||||||||

| Kevin A. Neveu | ||||||||||

| Gregory P. Raih | ||||||||||

| James A. Watt | ||||||||||

| Jeff E. Wojahn | ||||||||||

Inside Director | ||||||||||

Richard J. Carty | ||||||||||

Number of Meetings in 2015 | 6 | 7 | 4 | 2 | 2 |

| Legend | ||

|---|---|---|

Chairman of the Board | ||

Chairperson | ||

Member | ||

Financial Expert | ||

Each standing committee has adopted a formal charter detailing such committee's duties, functions and responsibilities. The charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are posted on the Company's website, www.bonanzacrk.com, and such charters are drafted in a manner consistent with the regulations of the SEC and standards of the NYSE.

In addition The information on our website is not, and shall not be deemed to the five standing committees, the Board formedbe, a Special Litigation Committee in July 2011 to conduct an investigationpart of allegations made by Frank H. Bennett, a co-manager of BCOC, against our President and CEO, Michael Starzer. The Board has also established a Key Employee Search Committee on anad hoc basis, which meets periodically as necessary, to assist management with searches for key membersthis proxy statement or incorporated herein or into any of our management team.

During 2012, each director attended at least 90% ofother filings with the meetings of the Board held after such director's appointment. All directors attended all meetings of each committee on which such directorSEC.

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 9 | |

served held after such director's appointment. The table below provides information regarding 2012 meetings of the Board and its committees.

2012 | Board | Audit | Compensation | Nominating and Corporate Governance | Reserve | Environmental Safety and Regulatory Compliance | Special Litigation | Key Employee Search | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Meetings | 12 | 13 | 9 | 4 | 2 | 2 | 0 | 4 | |||||||||||||||||

Attendance | >90 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | — | 100 | % | ||||||||||

Audit Committee |

The members of our Audit Committee are Messrs. Raih (Chairman), Chronister and Watt. Our Board has determined all three members of the Audit Committee to be financially literate and independent under the standards of the NYSE and SEC regulations and has also determined that Mr.each of Messrs. Chronister, Raih and Watt qualifies as an audit"audit committee financial expert.expert" as defined in SEC regulations. The Audit Committee oversees, reviews, acts on and reports on various auditing and accounting matters to our Board, including: the selection of our independent registered public accountants, the scope of our annual audits, fees to be paid to our independent accountants, the performance of our independent accountants and our accounting and reporting practices and processes. The Board has delegated to the Audit Committee all authority of the Board as may be required or advisable to fulfill the purposes of the Audit Committee as set forth in the Audit Committee's charter. The Audit Committee may form and delegate authority to subcommittees comprised of members of the Audit Committee. In addition, the Audit Committee oversees our compliance programs relating to legal and regulatory requirements and the Company's assessment and management of financial reporting and internal control risks. Additional information regarding the functions performed by the Audit Committee is set forth in the "Audit"Audit Committee Report"Report" included herein.

Mr. Raih also attends all meetings of the Company's Disclosure Committee, which is comprised of Company employees, in order to assist our principal executive officer and principal financial officer in ensuring that all disclosures made by the Company are (i) accurate, complete and fairly present the Company's financial condition and results of operations in all material respects and (ii) made on a timely basis as required by applicable laws and stock exchange requirements.

Compensation Committee |

The members of our Compensation Committee are Messrs. Watt (Chairman), Carty and Neveu. Mr. Watt replaced Mr. Carty as Chairman of the Compensation Committee effective April 19, 2013. The Board has determined that all current members of our Compensation Committee are independent under SEC regulations and the standards of the NYSE.

The Compensation Committee reviews and approves the goals and objectives relevant to the Company's chief executive officer's compensation, and, based on the Compensation Committee's own evaluation of the chief executive officer's performance in light of approved goals and objectives, recommends to the independent directors of the Board for their approval the total compensation of the chief executive officer. In addition,Chief Executive Officer based on the Compensation Committee annually reviewsCommittee's evaluation of the chief executive officer'sChief Executive Officer's performance in light of goals and objectives set and approved by the Nominating and Corporate Governance Committee. The Chief Executive Officer makes compensation recommendations regarding the compensation offor all other executive officers, and recommends the compensation, including salary and annual cash and equity incentive compensation, of such officers to the Board forCompensation Committee. The Compensation Committee then reviews such recommendations and makes its approval.own compensation recommendations to the Board. The Compensation Committee also oversees our compensation and benefit plans. The Board has delegated to the Compensation Committee all authority of the Board as may be required or advisable to fulfill the purposes of the Compensation Committee as set forth in the Compensation Committee's charter. The Compensation Committee may form and delegate authority to subcommittees comprised of members of the Compensation Committee. The Compensation Committee has sole authority to retain and dismiss compensation consultants and other advisors that provide objective advice, information and analysis regarding executive and director compensation. These consultants report directly to and may meet separately with the Compensation Committee and may consult with the Compensation Committee Chairman between meetings. Meetings may, at the discretion of the Compensation Committee, include members of the Company's management, other

members of the Board, consultants or advisors, and such other persons as the Compensation Committee or its Chairman may determine. Additional information regarding the functions performed by the Compensation Committee is set forth in the "Compensation"Compensation Discussion and Analysis"Analysis" section and the "Compensation"Compensation Committee Report"Report" included herein.

Nominating and Corporate Governance Committee

The members of our Nominating and Corporate Governance Committee are Messrs. Neveu (Chairman), Carty and Raih. Effective April 19, 2013, Mr. Chronister stepped off the Nominating and Corporate Governance Committee and Mr. Neveu joined the Nominating and Corporate Governance Committee and replaced Mr. Carty as its chairman. Our Board has determined that all current members of the Nominating and Corporate Governance Committee are independent under SEC regulations and the standards of the NYSE.

Nominating and Corporate Governance Committee |

The Nominating and Corporate Governance Committee identifies, evaluates and recommends qualified nominees to serve on our Board, develops and oversees our internal corporate governance processes and maintains a management succession plan. Our Board, through itsthe Nominating and Corporate Governance Committee, evaluates itself annually. The Nominating and Corporate Governance Committee endeavors to achieve an overall balance of diversity of experiences, skills, attributes and viewpoints among our directors. It does not discriminate based upon race, religion, sex, national origin, age, disability, citizenship or any other legally protected status. The Nominating and Corporate Governance Committee is also primarily responsible for reviewing and approving the goals and objectives relevant to the Company's Chief Executive Officer's performance and coordinating the annual evaluation of the Chief Executive Officer's performance based on such goals and objectives. The Board has delegated to the Nominating and Corporate Governance Committee all authority of the

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 10 | |

Board as may be required or advisable to fulfill the purposes of the Nominating and Corporate Governance Committee as set forth in the Nominating and Corporate Governance Committee's charter. The Nominating and Corporate Governance Committee may form and delegate authority to subcommittees comprised of members of the Nominating and Corporate Governance Committee. Additional information regarding the functions performed by the Nominating and Corporate Governance Committee is set forth in the "Other Matters—"Other Matters—Stockholder Proposals; Identification of Director Candidates"Candidates" section included herein.

Reserves Committee |

The members of the Reserve Committee are Messrs. Chronister (Chairman), Carty and Watt. Our ReserveReserves Committee oversees, reviews, acts on and reports to the Board on matters regarding our reserve engineering reports and reserve engineers. Our ReserveReserves Committee is responsible foroversees (i) the integrity of our reserve reports, (ii) determinations regarding the qualifications and independence of our independent reserve engineers, (iii) the performance of our independent reserve engineers and (iv) our compliance with certain legal and regulatory requirements.requirements relating to reserve reporting.

Environmental Safety and Regulatory Compliance Committee

Environmental, Health, Safety and Regulatory Compliance Committee |

The members of the Environmental Safety & Regulatory Compliance ("ES&RC") Committee are Messrs. Chronister (Chairman), Grove and Neveu. Our ESEHS&RC Committee's primary purpose is to assist our Board in fulfilling our responsibilities to provide global oversight and support of the Company's environmental, health, safety and regulatory and compliance policies, programs and initiatives. In carrying out its responsibilities, the ESEHS&RC Committee reviews the status of our health, safety and environmental performance, including processes monitoring and reporting on compliance with internal policies and goals and applicable laws and regulations.

In July 2011, our Board formed a Special Litigation Committee comprised of three non-employee directors—Messrs. Carty (Chairman), Chronister and Neveu—to conduct an investigation of the allegations of Frank H. Bennett, a co-manager of BCOC, against Michael R. Starzer, our President and Chief Executive Officer. During 2011, the Special Litigation Committee concluded that the allegations against Mr. Starzer were unsubstantiated and lacked merit. This matter was sent to arbitration in July 2011, and in November 2012, an arbitration panel found in favor of Mr. Starzer on all of Mr. Bennett's claims.

|

The Board encourages all directors to attend all annual meetings of stockholders, if practicable. All of our directors attended last year's annual meetingthe 2015 Annual Meeting of stockholders.Stockholders (the "2015 Annual Meeting"). We anticipate that all of our directors will attend the 20132016 Annual Meeting.

We do not have a "poison pill" or stockholder rights plan. If we were to adopt a stockholder rights plan, the Board would seek prior stockholder approval of the plan unless, due to timing constraints or other reasons, a majority of independent directors of the Board determines that it would be in the best interests of stockholders to adopt a plan before obtaining stockholder approval.

Any stockholder of the Company who desires to submit a proposal for action at the 2014 annual meeting of stockholders and wishes to have such proposal included in the Company's proxy materials, must submit such proposal to the Company at its principal executive offices no later than January 3, 2014, unless the Company notifies the stockholders otherwise.

The vote of stockholders required to amend our certificate of incorporation and bylaws is a simple majority vote.

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis ("CD&A") provides a general description of our executive compensation program and information about its various components. This CD&A is intended to place in perspective the information contained in the executive compensation tables that follow this discussion.

Executive Summary |

Throughout this discussion, theThe following individuals are referred to as the "named executive officers" for fiscal year 2015 and are included in the Summary Compensation Table:

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 11 | |

In March 2016, as part of a corporate reorganization and total workforce reduction, Messrs. Cassidy and Humber departed the Company. Further discussion regarding these executive departures and payments made in connection with terminations of their employment agreements can be found under "2015 and Selected 2016 Compensation Actions—Executive Departures."

Although the information presented in this CD&A focuses on our fiscal year 2012,2015, we also describe compensation actions taken before or after fiscal year 20122015 to the extent such discussion enhances the understanding of our executive compensation disclosure.

Strong Operating2015 Financial and FinancialOperational Results. DespiteBeginning in 2014, the uncertainty surrounding the global economyoil and continued volatilitynatural gas industry began to experience a sharp decline in commodity prices. Caused in part by global supply and demand imbalances and an oversupply of natural gas in the United States, the pricing declines have extended through 2015 and into 2016 and the timing of any rebound is uncertain. Low commodity prices in 2015 resulted in impairments and a reduction of our Company achieved strong operatingrevenues, profitability, cash flows, proved reserve values and stock price.

Our 2015 financial and operational results, for 2012, including the following:some of which were impacted by depressed oil, natural gas and natural gas liquid ("NGL") prices, included:

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 12 | |

| 2013 Peer Group | ||||||

|---|---|---|---|---|---|---|

| Company Ticker | TSR | Absolute Ranking | Percentile Ranking | |||

| | | | | | | |

| PDCE | 66.7% | 1 | 100.0% | |||

| CRZO | 51.2% | 2 | 88.9% | |||

| GPOR | –40.1% | 3 | 77.8% | |||

| NOG | –75.5% | 4 | 66.7% | |||

| BCEI | –78.3% | 5 | 55.6% | |||

| REN | –90.0% | 6 | 44.4% | |||

| REXX | –91.7% | 7 | 33.3% | |||

| AREX | –93.0% | 8 | 22.2% | |||

| GDP | –97.0% | 9 | 11.1% | |||

| SFY | –99.0% | 10 | 0.0% | |||

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 13 | |

| 2014 Peer Group | ||||||

|---|---|---|---|---|---|---|

| Company Ticker | TSR | Absolute Ranking | Percentile Ranking | |||

| | | | | | | |

| FANG | 49.0% | 1 | 100.0% | |||

| PDCE | –0.2% | 2 | 90.9% | |||

| CRZO | –17.5% | 3 | 81.8% | |||

| GPOR | –59.0% | 4 | 72.7% | |||

| NOG | –71.6% | 5 | 63.6% | |||

| BBG | –81.6% | 6 | 54.5% | |||

| BCEI | –85.5% | 7 | 45.5% | |||

| AREX | –90.5% | 8 | 36.4% | |||

| REN | –90.9% | 9 | 27.3% | |||

| REXX | –93.7% | 10 | 18.2% | |||

| SFY | –98.2% | 11 | 9.1% | |||

| GDP | –98.2% | 13 | 0.0% | |||

| 2015 Peer Group | ||||||

|---|---|---|---|---|---|---|

| Company Ticker | TSR | Absolute Ranking | Percentile Ranking | |||

| | | | | | | |

| PDCE | 50.7% | 1 | 100% | |||

| NFX | 27.0% | 2 | 92.3% | |||

| FANG | 22.6% | 3 | 84.6% | |||

| SYRG | –11.2% | 4 | 76.9% | |||

| CRZO | –15.7% | 5 | 69.2% | |||

| QEP | –35.7% | 6 | 61.5% | |||

| NOG | –41.4% | 7 | 46.2% | |||

| SM | –38.2% | 8 | 53.8% | |||

| GPOR | –45.9% | 9 | 38.5% | |||

| WPX | –46.4% | 10 | 30.8% | |||

| BBG | –53.2% | 11 | 23.1% | |||

| BCEI | –74.3% | 12 | 15.4% | |||

| HK | –80.1% | 13 | 7.7% | |||

| REXX | –80.5% | 14 | 0.0% | |||

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 14 | |

2016 Outlook and Business Strategies. Despite the current depressed commodity pricing environment, our management is committed to preserving value by maximizing the cash flows from our existing production, optimizing the Company's liquidity position and positioning existing leasehold for increased development activity when increased commodity prices are observed. Business strategies for 2016 include:

Strategy | Action | |

|---|---|---|

| 2016 Liquidity | In March 2016, with the goal of reducing uncertainty and securing liquidity, we elected to draw down $209 million on the Company's revolving credit facility to place additional cash on the Company's balance sheet and restructured our commodity derivative contracts to protect a greater percentage of our 2016 forecasted production. We continue to evaluate additional strategies to reinforce our balance sheet and improve our liquidity which include potential asset sales and joint ventures or other arrangements that would enable us to support development of our core areas with additional third-party capital, debt restructurings, the issuance of new debt or equity and conservation of our liquid assets. The outcome of these potential alternatives, the timing of which cannot be accurately predicted at this time, are likely to affect our liquidity, future operations and financial condition. | |

2016 Capital Expenditures | We expect to control our reduced liquidity during 2016 by scaling back our capital expenditures to match the current commodity pricing environment. Although we cannot predict or control future commodity prices, our expected 2016 capital expenditure budget has been decreased to accommodate market expectations of reduced commodity prices. We have a modest capital program of $40.0 million to $50.0 million planned for 2016 in order to conserve our liquid assets. | |

Cost-Reduction Initiatives | We have taken steps to reduce our future capital, operating and corporate costs. During 2015, we continually negotiated with our primary suppliers and service providers resulting in an approximate 29% reduction in our drilling and completion costs on our standard reach lateral wells and an approximate 12% reduction in our lease operating expense per Boe. We also took measures in September 2015 to reduce corporate costs by reducing our workforce by approximately 13%, which resulted in a $5.3 million reduction in general and administrative expense on an annual basis. In March 2016, we further reduced our workforce by approximately 10% in order to align our employee base and general and administrative cost structure with the current commodity price environment and our resulting anticipated activity level. This additional workforce reduction is expected to reduce general and administrative expense and lease operating expense by approximately $7.6 million and $3.1 million, respectively. We intend to continue to focus on cost reduction opportunities throughout 2016. |

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 15 | |

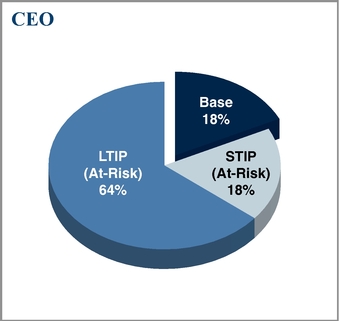

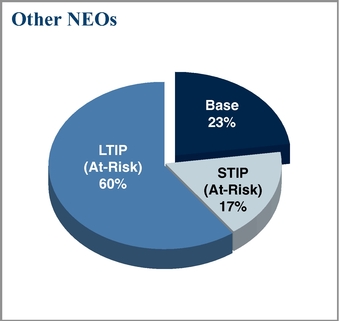

Features of Our Compensation Program.Program in 2015. We strive to create a compensation program that encourages long-term value creation by tying individual compensation to the attainment of our annual performance targets and the long-term performance of our stock while acknowledging and fostering the unique qualifications, skills, experience and responsibilities of each individual. Key features include:

The following table summarizes the key features of our executive compensation program.Practices that We Engaged in or Allowed in 2015

| ü | Pay for Performance—Our executives' total compensation was substantially weighted toward performance-based pay. Our annual cash incentive awards, which were fully at-risk, were based on performance against pre-set key financial, operational and strategic execution performance indicators. Our long-term equity compensation awards were comprised of 50% performance stock units which were earned based on our relative total shareholder return against our peers and were fully at-risk. | |||

ü | External Benchmarking—Our Compensation Committee reviews competitive compensation data based on an appropriate group of exploration and production peer companies prior to making annual compensation decisions. | |||

ü | Mitigation of Undue Risk—We conduct a risk assessment annually to carefully consider the degree to which compensation plans and decisions affect risk taking. We do not believe that any of the compensation arrangements in place are reasonably likely to have a material adverse impact on the Company. | |||

ü | Robust Stock Ownership—We have adopted robust stock ownership guidelines for our executives and directors. | |||

ü | Minimum Vesting—Our annual equity awards provided for minimum three-year vesting, except in limited circumstances involving certain terminations of employment. | |||

ü | Double-Trigger Equity Acceleration upon a Change in Control—Under our Amended and Restated Executive Change in Control and Severance Plan (the "Severance Plan"), vesting acceleration of equity incentives following a change in control only occurs if the executive is terminated without cause or resigns for good reason within 18 months following a change in control. | |||

ü | Independent Compensation Consultant—We have engaged an independent executive compensation advisor who reports directly to the Compensation Committee and provides no other services to the Company. | |||

ü | Focus on Total Compensation—Our Compensation Committee conducts a detailed analysis of total compensation prior to making annual executive compensation decisions. | |||

ü | Consistently Timed Awards—Awards are not timed for recipients to benefit from the release of material, non-public information. |

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 16 | |

Best Practices in Our Executive Compensation Program

Practices that We DoDid Not Engage in or Allow

in 2015

| No Excise Tax Gross-Ups—Neither our Severance Plan nor our employment agreements provide for excise tax gross-ups. | ||||

| No Repricing or Backdating—Our LTIP prohibits the repricing, backdating or buyouts of stock options or stock appreciation rights. | ||||

| No Hedging or Derivative Transactions in Company Stock—We prohibit our executives from engaging in any short-term trading, short sales, option trading or hedging transactions related to our common stock. We also prohibit our executives from purchasing our common stock on margin. | ||||

| Minimal Perquisites—We offer minimal perquisites to the Company's executives, few of which are not offered to all of the Company's employees. The Company believes executive salary and short-term incentive program ("STIP") payments, as well as LTIP grants, fully compensate our executives. |

Compensation Committee Consideration of 20122015 Stockholder Advisory VotesVote on Our Compensation Program. Our Compensation Committee is continuously mindful of our stockholders' views on executive compensation. We believe our stockholders' strong support of our executive compensation program at our 20122015 Annual Meeting of Stockholders reaffirmed our compensation program. At our 20122015 Annual Meeting, ninety-nineapproximately seventy five percent (99%(75%) of the advisory votes cast on the question of whethervoted to approve our named executive compensation voted in favor of approving it, and (94%) of the advisory votes cast on the question of the frequency with which we should include advisory proposals regarding executive compensation voted to have such advisory votes every year. In light of these voting results, theofficer compensation. The Company determined that it will hold an advisory vote on executive compensation every year until the next required advisory vote with respect to the frequency of advisory votes on executive compensation, which will occur no later thanat the Company's annual meeting of stockholders in 2018.

Recent ChangesHighlights of 2015 Compensation Actions. As a result of depressed oil and gas commodity prices, discussions with our investors and ongoing deliberations by our Compensation Committee (with input from the Compensation Consultant), we made changes to our executive compensation program in 2015. The table below summarizes key actions taken in 2015:

Element | Action | |

|---|---|---|

| Flat Base Salaries | In early 2015, our Board and Compensation Committee elected to not increase the base salary for any named executive officer in 2015, down from approximately 12% increases made in 2014. | |

STIP Metrics | A new 2015 STIP key performance indicator ("KPI") metric was added specifically for our named executive officers related to execution of the Company's strategic plan, as presented to and approved by the Board, intended to emphasize the Company's focus on the critical nature of successful execution of the Company's business plan in a depressed market. This new strategic execution KPI was added in place of a prior KPI related to proved reserves additions and comprised 25% of the aggregate 2015 payout potential. | |

Peer Group | Slight changes were made to the Company's peer group to more closely align peer compensation benchmarking with companies possessing a more similar corporate profile and strategic outlook. |

2016 Compensation Program. Our Board and Compensation Committee remainsremain focused on structuring our compensation program to ensure proper alignment of pay with performance. During 2012As the Board and the first quarter

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 17 | |

Compensation Committee continue to evaluate the impact of the severely depressed market conditions on the Company, the only decision made to date with respect to 2016 compensation is that relating to base salary. Our Board and the Compensation Committee have decided to keep base salaries for the named executive officers at their 2015 levels with no increases. No decisions have yet been made regarding our 2016 STIP metrics or our long-term incentive compensation, however, we made a number ofexpect to make changes to our executivelong-term incentive compensation program includingin 2016 due to the adoptionlimited number of shares available under our LTIP and the following:

Compensation Program Philosophy and Objectives

Methods to Achieve Compensation Objectives |

At Bonanza Creek, we view our employees as an investment for the future. We invest in our people for the future opportunity to continue to grow our business and deliver more value to our stockholders. The objectives of our compensation program are:

We design our compensation program to reward employees for performance that creates stockholder value, in that incentive compensation is only earned by successfully implementing our long-term strategy andor by achieving our short-term

goals. We strive to create aOur compensation program, that rewards performance while acknowledgingincluding review of benefits and fostering the unique qualifications, skills, experience and responsibilities of each individual.perquisites, is reviewed by our Compensation Committee annually.

Executive Compensation Risk |

The Compensation Committee has designed our short-2015 short-term and long-term compensation programs with features that reduce the likelihood of excessive risk-taking, including a balancedan appropriate mix of cash and equity and short-short-term and long-term incentives, caps on short-term bonus program payouts, an appropriate balanceweighting of fixed and at-risk compensation components, an appropriatea balance of operating, financial and financialstrategic execution performance measures, significant stock ownership requirements for officers, extended vesting schedules on equity grants caps on incentive awards and prohibitions on engaging in derivative transactions in our common stock. We do not believe that our current or proposed compensation policies and practices encourage excessive or unnecessary risk-taking and have determined that risks arising from our compensation policies and practices are not reasonably likely to have a material adverse effect on us. We do not believe that our current or proposed compensation policies and practices encourage excessive or unnecessary risk-taking.

Setting Executive Officer Compensation

Setting Executive Officer Compensation |

Role of Our Board and Compensation Committee. Our Compensation Committee (i) oversees our compensation programs on behalf of our Board; (ii) is responsible for proposing programs for approval by our Board that attract, retain and motivate qualified executive-level talent; (iii) monitors our compensation programs and strives to ensure that the total compensation paid to our executive officers is fair, reasonable and competitive with thattotal compensation provided to executive officers serving in similar roles and with similar responsibilities in other U.S. publicly traded energy companies; and (iv) makes proposals to our independent directors regarding the compensation of our chief executive officer.Chief Executive Officer. Our chief executive officerChief Executive Officer makes proposals to our Compensation

| BONANZA CREEK ENERGY, INC.2016 Proxy Statement | 18 | |